Don’t Go Dark: Unpacking the Summer Advertising Slump Myth

For Advertising Agencies: The Data-Driven Case Against the Summer Slowdown

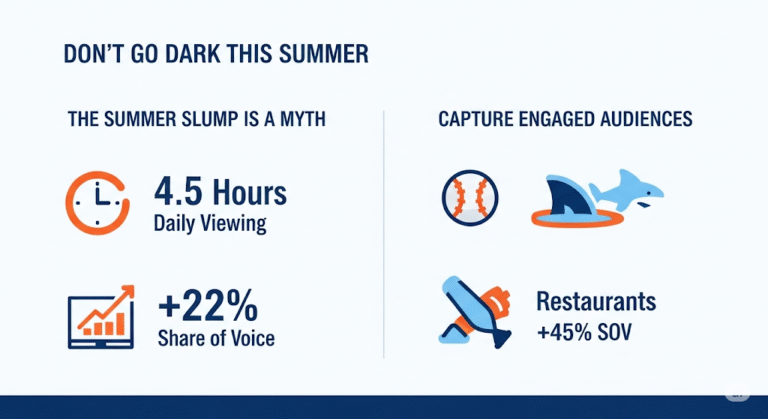

Is your team still advising clients to decrease ad spend during the summer? An outdated belief that viewership disappears in Q3 has led 20% of advertisers to consistently go dark, creating a predictable, seasonal vacuum [p. 3].

New data from Comcast Advertising’s “2025 Summer Viewing MWR” report exposes this “summer slump” as a myth and reveals a powerful opportunity for the clients you represent [p. 1]. For agencies that leverage this insight, summer is no longer a dead zone—it’s a competitive playground [p. 3].

The Core Insight: A 22% Average Increase in Share of Voice

While one-fifth of the competition is on vacation, viewers are not. This advertiser exodus creates a less cluttered environment where your clients’ messages can dominate [pp. 3-4]. Brands that maintained their TV and streaming campaigns through the summer saw an average overall Share of Voice (SOV) increase of 22% [pp. 3-4].

This “summer dividend” offers a compelling, data-backed strategy to present to your clients, with massive potential gains in key verticals:

- Restaurants: +45% SOV [p. 4]

- Home Improvement: +35% SOV [p. 4]

- Furniture: +35% SOV [p. 4]

- Health & Wellness: +34% SOV [p. 4]

- Travel: +30% SOV [p. 4]

This is a strategic advantage you can build directly into your media plans to deliver exceptional client results.

Debunking the Myth: Viewership is Stable, Platform Preference Shifts

Arm your team with the facts: audiences do not tune out in the summer.

- Consistent Viewership: Daily time with TV and streaming holds steady at nearly 4.5 hours per day year-round. Summer viewing (4h 29m) is right in line with pre-summer (4h 26m) and post-summer (4h 32m) metrics [p. 3].

- Platform Shift to Your Advantage: The crucial insight for media planning is where they are watching. Annually, cable and streaming capture 67.3% of video time, and that combined share grows during the summer months [p. 2]. In key markets, this effect is even more pronounced, with cable’s share of viewing time reaching:

- 70% in Indianapolis [p. 12]

- 67% in Detroit [p. 9]

- 63% in Chicago [p. 7]

- VOD Growth: On-demand viewing also rises to fit flexible summer schedules. Adults in Chicago and Detroit spent an average of 33 minutes per day with VOD from June to August [pp. 8, 10].

Strategic Content Alignment: Placing Buys Against "Can't-Miss" Summer Programming

Summer is no longer a season of reruns; it’s a tentpole season. The 2025 calendar offers a wealth of high-engagement opportunities to build impactful media plans around [p. 15].

- Dominate with Live Sports: With 89% of cable sports programming watched live, it’s a powerhouse for reaching engaged audiences that spans 83% of Comcast households [p. 5]. The 2025 lineup is stacked:

- NBA & NHL Finals [p. 15]

- FIFA Club World Cup [p. 15]

- WNBA & MLB Regular Seasons [p. 15]

- PGA’s US Open & Tennis Slams [p. 15]

- Align with Cultural Moments: Beyond sports, premium programming drives viewership and cultural conversation. Build plans that include:

- Returning hits like FX’s “Welcome to Wrexham” [p. 15]

- Iconic events like Discovery’s “Shark Week” [p. 15]

- Major award shows like the ESPYs and BET Awards [p. 15]

The Takeaway for Your Agency:

The summer advertising slump is a costly relic. The competitive landscape is wide open, audiences are engaged, and premium inventory is rich with opportunity. Use this data to advise your clients to reject the myth, stay on the air, and seize an unmatched opportunity to grow their market share while their competitors are sitting on the sidelines.

Source: “2025 Summer Viewing MWR.” Comcast Advertising, 2025.

Ready to learn more?

Let's chat!